AvaTrade Review 2018: Platform for Experienced Traders

AvaTrade is a Forex & CFD broker and enriched with knowledge, experience and technology which we are going discuss step by step in our AvaTrade Review.

A group of experts are behind of it.

This is the broker interested to work with experienced traders along with new brokers.

To achieve its aim, it has designed all of the services (including options, assets, accounts and customer service) with much effort and Excellencies.

Another aim of this broker is to make Forex & CFD profitable for the traders.

That is why this broker is working relentlessly around the clock.

Let us discover the specialty of this broker in the review.

Warning: Country Restriction (Do Not Accept Traders)

Warning: Please note that, AvaTrade Broker does not accept traders from the following countries –

AvaTrade Review

High Capital Risk Is Involved In Financial Trading

From 2006, AvaTrade started its venture in Forex & CFD trading.

It has already gained much attention from new and old traders; earned million’s trust through strict regulation, integrity and transparency.

Within a few short years, AvaTrade has expanded enormously, with over 200,000 registered customers globally executing more than two million trades a month.

The company’s total trading volumes surpassed $60 billion per month.

However, it was established in 2006.

It is owned by Ava Trade Ltd.

Its headquarter is located at Five Lamps Place, Amiens Street, Dublin 1, Dublin, Ireland.

AvaTrade is not only regulated and licensed by the Central Bank of Ireland, but also by various other international regulators such as ASIC, BVI Financial Services Commission, Japan’s Financial Services Agency and the Financial Services Board in South Africa.

AvaTrade uses Metatrader4 platform with low floating spreads with a leverage of 4001:1.

This platform’s interface is very user friendly.

A new trader can easily operate it.

It also uses SSL security system to protect customers’ data, trading history and transaction.

Education Center is very rich.

It is filled with e-book, video courses and webinars.

Only registered will get access to use it.

It has a mobile application, trading is possible from both PC and mobile phone.

Because it uses web based technology, so it is unnecessary to download any extra software.

Why AvaTrade?

It is not a surprise that a new trader always tries to find out some unique and special features of a broker before making a final decision.

That is why we usually examine a broker before writing a review on it.

We did the same thing to find out unique features of AvaTrade.

We have got some and let us check those given in the below.

- Trusted & Regulated broker

- Maximum payout 90%

- Minimum deposit $100

- Minimum investment $0.01

- Up to 400:1 leverage

- Demo Account

- range of automated trading platforms and EA & MQL5 compatibility

- 250+ instruments

- 100% Bonus

- Enriched Education Center

- Multiple Trading platform (Metatrader4, AvaTradeAct, AvaOptions etc)

- Resources (Autochartist, Market Analysis, Fundamental Analysis, Economic Calender)

- 24/5 help and support in 12 languages

Trading Platforms

There are 8 different trading platforms available at AvaTrade.

Each platform has been designed to fulfill clients’ needs and demands.

All these facilities are lucrative and extremely useful especially for new traders.

We think these are enough to make Forex & CFD easy to use and make money.

However, these platforms are –

1. Meta Trader 4 –

- Transparent low pricing from 0.8 pips

- Flexible lot sizes – from 0.01 micro lots

- Free auto-trading with full EA compatibility and MQL5 support

- Phone & tablet trading with free iOS/Android apps

- Live multi-language trader support team

- Exclusive daily market analysis and education materials

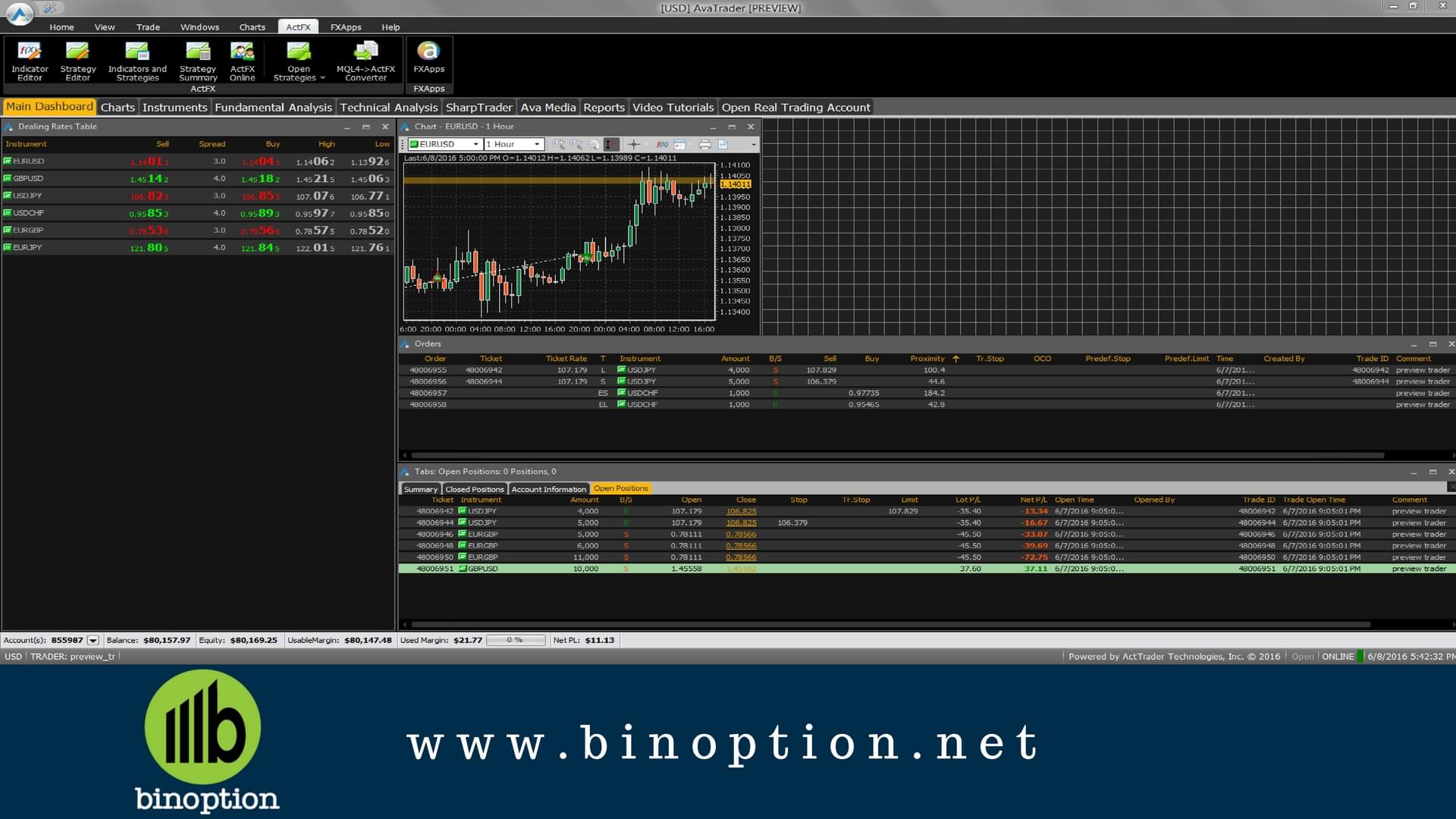

2. Ava Trade Act –

- Trade 200+ financial instruments at low fixed spreads

- Make bigger trades with leverage of up to 200:1

- Utilize a comprehensive range of orders, alerts & charting tools

- Always be ready to trade with web-based, tablet and mobile apps

- Get live support – in your language – whenever the markets are open

- Count on the protection of trading with a globally regulated broker

3. Floating Spread –

- More than 60 FX pairs with spreads as low as 0.9 pips

- Get leverage of up to 400:1 on your trades

- Powerful and customisable MetaTrader 4 trading platform

- Tablet and phone trading with free iOS and Android apps

- Live support in your language 24 hours/5 days

- Enjoy the protection of trading with a globally regulated broker

4. Ava Options –

- Complete Platform

- Range of Expirations

- Strategy Optimizer

- Risk Manager

5. Automated Trading –

- RoboX

- Mirror Trader

- Zulu Trade

- MQL5 – Signals Service

- AvaTrader API Libraries

High Capital Risk Is Involved In Financial Trading

Fixed, Floating and Options Spreads Reduced by 35%

We are happy to announce the reduction of spreads across the board by an average of 35%, for fixed, floating and options spreads.

Their new Forex spreads can now go as low as 0.7 during liquid times!

Below you will find the lists of top new spreads.

Floating and Options Spreads:

| Instrument | New Base Floating |

| EURUSD | 1.50 |

| USDJPY | 1.60 |

| GBPUSD | 2.00 |

| USDCAD | 2.50 |

| AUDUSD | 2.20 |

| USDCHF | 2.10 |

| NZDUSD | 2.80 |

| GBPJPY | 3.00 |

| EURJPY | 2.50 |

| Gold | 0.400 |

Fix Spreads:

| Instrument | New Base Floating |

| EURUSD | 1.90 |

| USDJPY | 2.00 |

| GBPUSD | 2.40 |

| USDCAD | 3.00 |

| AUDUSD | 2.50 |

| USDCHF | 2.50 |

| NZDUSD | 3.00 |

| GBPJPY | 4.00 |

| EURJPY | 3.20 |

| Gold | 0.50 |

Trading Info

4 types of orders are available at AvaTrade. These are –

- Market Orders

- Limit and Stop Orders

- Entry Orders

- One Cancels the Other Orders

Trading Hours are below –

- Opening (Sunday 21.00 GMT)

- Closing (Friday 21.00 GMT)

Asset Index

Assets are huge in number.

Near 250+ assets are available to trade.

It is a great privilege to have such a large number of assets.

It definitely increases the chance of working with favorite and popular company.

Having vast assets is trader’s friendly initiative.

However, these assets are scattered in multiple groups.

Such as –

- Forex

- CFD Trading

- Stocks

- Bitcoin

- Gold and Metals

- Oil and Energies

- ETF Trading

- Treasuries

- Indices

- Litecoin

- Agriculturals

Avatrade Web Trading Platform Overview

High Capital Risk Is Involved In Financial Trading

Avatrade Act FX Trading Platform Overview

High Capital Risk Is Involved In Financial Trading

Avatrade Currency and Bitcoin Trading Platform Overview

High Capital Risk Is Involved In Financial Trading

Deposit & Withdrawal

It is safe to work with AvaTrade.

This broker is very caring to secure client’s data, trading history and transaction.

Though, it uses the internationally recognized 256-bit SSL security systems which encrypts data and prevents it from leaking or loosing.

However, AvaTrade is PCI compliant.

It means this broker does not hold client’s credit card information.

Embedded True-Site identity assurance seal Ava is Web Trust compliant, as determined by the American Institute of Certified Public Accountants. Ava uses McAfee Secure (HackerSafe) to prevent credit card fraud and identity theft.

All client money is segregated from Ava Trade business funds.

Deposit and transaction are simple, fast and hassle free.

The minimum deposit is $100 and minimum withdrawal also $100, and during withdrawal verification is required.

Both can be done through various mainstream banking channel including Visa, Master Card, JCB, Bank Wire etc.

Withdrawal is if free of charge.

An AvaTrade client can apply for Ava Debit Master Card and it takes up to 28 days to receive.

It takes 5 working days to process the withdrawal request and Ava premium clients can withdraw their money within 24 hours.

Customer Service

AvaTrade provides an excellent customer service.

We have checked their customer support and found it proactive, cordial and immediate.

Support is available in different formats (like e-mail, phone, live chat etc.) with multiple languages.

All these services are available 24/5.

They have 11 regional offices and they are in Ireland, Italy, Japan, China, France, Australia, Mongolia, Nigeria, Spain, Chile and South Africa.

You can even seek experts’ help using above mentioned services and will get immediate reply.

This broker has a group of experts ready to help and answer any query of the clients.

We usually prefer live chat.

You should try it if there is any need of help.

Drawback

It is normal to have some drawbacks.

But it is our utter surprise we did not find anything major.

Yet, we will mention some which we think needed to be discussed.

The FAQ section of this broker is not enriched.

This broker doesn’t accept USA traders for regulatory reason.

Warning: Country Restriction (Do Not Accept Traders)

Warning: Please note that, AvaTrade Broker does not accept traders from the following countries –

Conclusion

From our observation and research in this Avatrade Review, we can say that AvaTrade is not a scam.

It is rather one of the best platforms in Forex & CFD trading.

It will be a pleasure to work with this broker.

As its intention is to guide traders towards success then it is a great chance to work with it.

Let us work with AvaTrade.