What Are Binary Options Trading? – Binary Options Explained

Binary Options are known for their simplicity and all-or-nothing nature but what exactly are options in the first place and What are Binary Options Trading?

Why are binary options given this name? How do you trade binary options?

These are the questions that we’ll attempt to answer in this guide.

This article is meant as a guide for beginner traders and hence, we will keep it as simple as possible.

Let us define options first. Options are derivative instruments.

They derive their value from whichever underlying financial asset they are being traded as.

Options can be traded as forex pairs, cryptos, stocks, indices, commodities, etc.

What Is Binary Options Trading?

Binary Options are financial exotic options which allow traders to speculate on the price movements of various underlying instruments.

They are also known as digital options or all-or-nothing options.

When trading binary options, you don’t own the underlying asset; you rather bet whether its price will increase above or decrease below the strike price or the purchase price.

The strike price is the price at which the underlying asset is being traded.

The market price must increase or decrease by the time the trade expires.

The time from when you place the trade until the time the trade expires is the trade expiry period.

The expiry period for binary options is very diverse. Trades can be as short as 30 seconds or last up to a year.

When you predict the price of the asset will increase, you buy a call option.

When you predict the price of the asset will decrease, you buy a put option.

You win a payout if you guess accurately. On the other hand, you don’t gain anything if you guess wrong.

This is why they are called binary.

The payout rate depends on the payout percentage.

The payout ratio differs from asset to asset and broker to broker.

Speaking of assets, there are multiple assets that you can trade as binary options (Stocks, commodities, indices, currencies, and even cryptos).

Trading binary options with cryptocurrency is the latest trend among traders.

You will find many strategies on how to trade binary options with Bitcoin and other altcoins.

Cryptos are very volatile in nature and being able to accurately guess the market can bring in great profits.

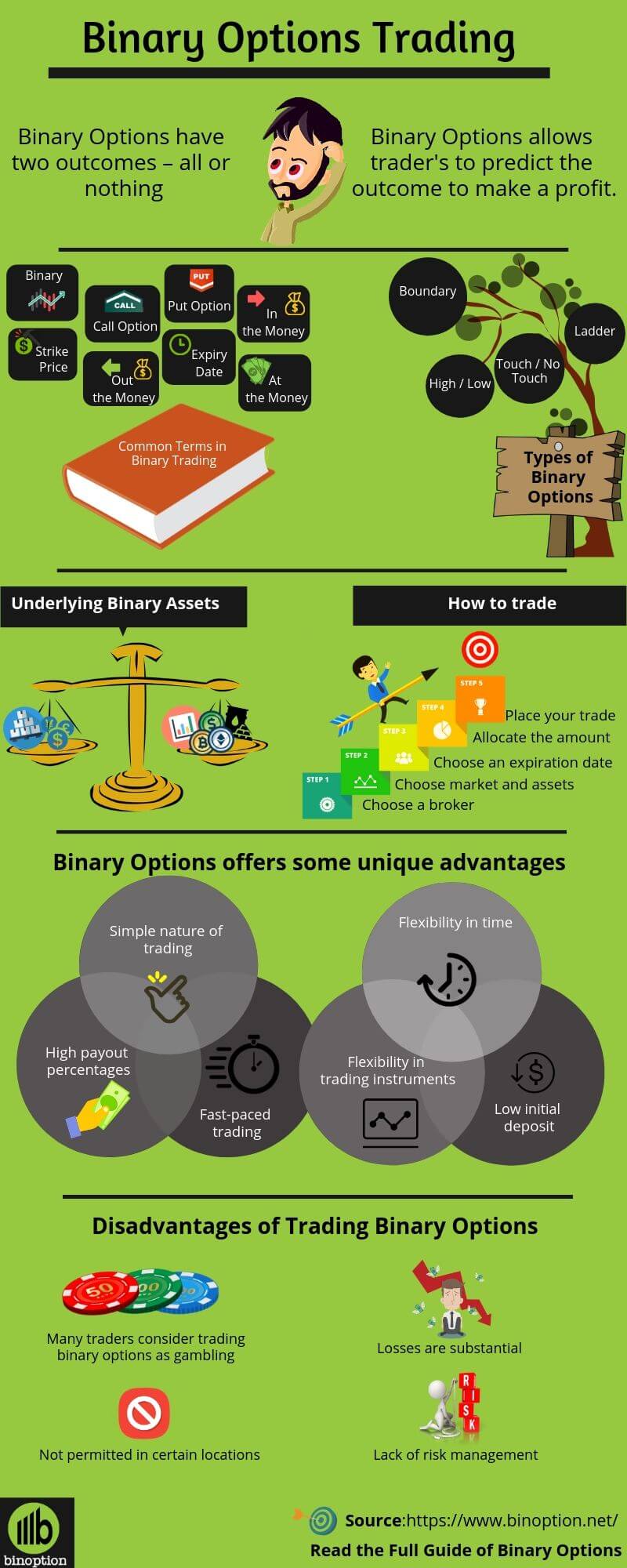

There are 4 classifications of binary options: High/low, in/out, touch/no touch, and ladder.

To explain briefly, high/low is the most common type of binary trading.

By accurately predicting if the market price will be less or more than the strike price at the end of expiry period will reward you a payout.

In/Out binary options involve a price boundary. You have to predict if the market price will remain within the boundary or outside of it when the time expires.

Touch/no touch is a type of binary options with high payouts in which the market price should touch at least once / not touch the strike price before the end of expiry.

The payout depends on the distance between the strike price and the market price and the duration of the expiry period.

Finally, ladder binary options feature multiple price limits. Each limit carries a different payout percentage.

The market price must move from its current position to one of the ladders.

Greater the price movement, higher the payout.

Payout percentages reach up to 1000% in the case of ladder binary options.

When you win a binary options trade, it is referred to as “in the money”.

When the opposite happens, it is referred to as “out the money”.

When your strike price and market price are the same at the end of the expiry period, it is referred to “at the money”.

Above, I gave a summary on all terms and facts for binary options trading. Now I am going to explain all the terms and facts that will give you more knowledge to understand.

What Is Binary Options? – Video Explanation

What are the Different Types of Binary Options Trading?

There are four types of binary options. They are:

High / Low:

This is the most common type of binary option.

Here, the trader buys a call option if he thinks the price of the asset will increase from the current market value.

If he thinks the price of the underlying asset will drop compared to the current market price, then they will open a put option.

In / Out or Boundary:

In this form of binary options trading, traders have to predict whether the price of the asset they have chosen will stay within a given price boundary or stay out of it.

The upper and lower limits of this boundary or range are determined by the broker and the trader selects the time duration and the asset of his preference.

Like high/low, if the trader accurately predicts the outcome, he gets a payout and if he loses he gains nothing and loses his initial payment.

Touch / No Touch:

In high/low and in/out binary options trading, the payout is fixed.

However, this is not the case for touch/no touch options.

In no touch binary options, the trader selects a strike price that is above or below the current market price.

He then selects his expiration time and then places the trade.

To secure a payoff, the market price of the underlying asset should not coincide with or exceed the strike price before expiry.

This is where variable payouts come into play.

The closer the market price is to the strike price, the higher is the payout.

Another area where no touch options differ from high/low is the payout percentage.

Payouts for high/low rarely exceed 95%.

But in the case of no touch, traders can enjoy a payout of 200% or higher.

In some cases, it even exceeds 500%.

Touch binary options, also known as one-touch binary options are the exact opposite of no-touch binary options trading.

In one-touch binary options, the market price of the underlying asset much reach the strike price at-least once before the expiry.

The payout depends on the distance between the strike price and the market price and the duration of the expiry period.

The further market price is away from the strike price, higher the payout. Longer the expiration period, lower the payout percentage.

Ladder:

In boundary binary options, there is an upper limit and a lower.

In the case of ladder options, however, there are multiple price limits.

The exact number of limits depends on the broker and the underlying asset that you are trading.

Each limit has a different payout percentage. And for each price limit, there is an ‘above’ or ‘below’ trade option.

These are commonly referred to as ‘call’ and ‘put’ by most brokers.

Like one-touch options, the payout for ladder options exceeds 100%.

Each ladder is a different price point and requires price movement from the current market price.

Greater the price movement, the higher the payout percentage.

Common Terms in Binary Options Trading

Before you can trade binary options, there are some common terminologies that you should know. We have listed them here.

Binary: The term ‘binary’ is used because there are two possible outcomes. You predict accurately and earn a payout, or you are wrong and gain nothing.Call Option:A trader chooses a call option when he predicts the price of the underlying asset will increase before the expiration period. If the strike price increases within that expiration period, then the trader earns a payout.

Put Option:A trader chooses a put option when he predicts the price of the underlying asset will decrease before the expiration period. If the strike price decreases within that expiration period, the trader will earn a payout.

Strike Price:It is the price at which the put or call option can be exercised. The strike price is also referred to as purchase price. Since it is the price at which you purchase the option. When the option expires, the new market price is compared to the strike price to find out if you have earned a payout or lost your initial investment.

Expiry Date:The time when the binary options asset expires.

In the Money:When you win a binary options trade, it is referred to as “In the Money”. When you accurately make a prediction and win a payout, you are ‘in the money’.

Out the Money:When you lose a binary options trade, it is referred to as “Out the Money”. It is the situation when your price prediction goes wrong and you gain nothing.

At the Money: At end of the expiry period, if the strike price matches that of the market price, then that position is referred to as “At the Money”. In this case, you don’t win or lose anything and your initial investment is returned to you.

Binary Options Trading Underlying Assets

With Binary Options, you get the flexibility to trade a variety of assets. Among the many that are available, the most popular ones are stocks, forex, commodities, indices, and cryptos.

“RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK”

They are considered as the future of fiat currency. The first crypto ‘Bitcoin’ was released in 2009 and since then more than 2000 cryptocurrencies have been available. The crypto market is generally volatile in nature and great profits can be made if they are traded the right way. Popular cryptos include Bitcoin, Ripple, Ethereum, Stellar, Tether, etc.

“RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK”

How to trade Binary Options?

Here’s how you can trade binary options:

Step 1: Choose a broker

The first step is to choose a binary options broker. There are many fraudulent brokers out there that you must be aware of. The factors that you should be looking into before choosing a binary options broker can be found here.

Here is the list of brokers that we think will offer you the best binary options trading experience:

Step 2: Choose your market and asset

As discussed above, there are a lot of markets to choose from in binary options. Choose your preferred market and then an asset from that market. Make sure you trade on those assets that you have prior experience and knowledge. For example, if you are a crypto trader, stick to cryptocurrencies.

Step 3: Choose an expiration date

From the moment you place your trade till the time you get to know the outcome of your trade is the expiration period. You get to choose this time interval. The expiration times can be as low as 30 seconds to all the way up to one year.

Step 4: Allocate the amount to be invested

After selecting the expiration period, you have to choose how much money you are willing to invest in the trade. With binary options, it is possible that you lose your entire investment due to its all-or-nothing nature. Hence start low, especially if you are a new trader. Invest low and work your way up using targeting small profits per trade.

Step 5: Place your trade

Check every detail and then confirm the trade. After the trade expires, you will know whether you have made money or lost the trade.

Now you got a basic concept to trade binary options, but if you want a vast knowledge then read this guide – Learn How To Trade Binary Options Successfully For Beginners and it will teach you step by step to trade binary options successfully.

“RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK”

Binary Options Explained – Example of a Binary Options Trading

We will explain the most commonly used high low/ call put method of binary trading using an example:

Consider the following situation: You are a forex trader.

You are particularly interested in trading the EUR/USD pair.

The payout percentage your broker offers for this asset is at 90%.

The first thing that you need to determine is your expiration time.

Say you have chosen 10 minutes as the expiration period.

Next, you need to predict if the market price of EUR/USD will close above or below the current purchase price.

If you think, the price will close above, you buy a call option.

If you think the market price will close below, you buy a put option.

It doesn’t matter how much the price has to be above or below.

All you need to do to win a payout is guess accurately.

The term guess is used vaguely here.

It involved a lot of analysis using trading tools and indicators and following the market news for that underlying asset.

After your market analysis, you decide to buy a call option because you think its price will rise from the strike/purchase

price which is currently at 1.14.

You decide to invest $10 in this trade. As the payout is 90%, you either earn a 90% return or get nothing in return.

Let’s examine the two scenarios.

If your prediction is correct (EUR/USD price rises above 1.14 after expiry), you get 10 + (90% of 10) which is equal to $19.

If your prediction is wrong (EUR/USD price drops below 1.14 after expiry), you get nothing in return i.e. $0.

Advantages of Trading Binary Options

Binary Options offers some unique advantages that can be utilized for earning quick profits. We have listed some of the major advantages down below:

1.High payout percentages:

Most popular brokers such as IQ Option , Binomo, Expert Option, etc offer very high payout percentages (upwards of 90%).

Our binary options trading review on these brokers will give you more information on them.

A high payout percentage makes these brokers very attractive to all kinds of traders.

At the very least, you can earn 75% payouts. Compared to other trading methods, binary options have better returns.

2.Simple nature of trading:

Nothing is simpler than binary. It’s either 1 or 0, i.e. all or nothing.

You either win money or you don’t gain anything.

Binary trading’s simplicity attracts many beginner traders to try it.

Other forms of trading are far more complex and may intimidate new traders but such is not the case here.

3.Fast-paced trading:

Binary trading is usually meant for short-term trading.

This makes the trading experience fast and exciting.

Although, a bit risky, you can earn some quick cash using this form of trading.

With binary options, your expiration can be as low as 30 seconds.

4.Flexibility in time:

As discussed in the previous point, your expiry period can be as low as 30 seconds.

But that doesn’t mean you cannot trade long-term with options.

Your trades can last as long as a year. With such variety in expiry times, binary options can cater to all kinds of traders.

5.Flexibility in trading instruments:

With binary options, you are not limited to one or two asset types.

You can trade stocks, indices, commodities, indices, cryptos and much more as binary options.

6.Low initial deposit:

Most binary options brokers offer low initial deposits so that new and small traders can get started.

Some of the brokers demand as low as $5 or $10 as initial deposits.

Disadvantages of Trading Binary Options

Along with the benefits, trading binary options also possess some disadvantages. We have listed the major disadvantages down below:

1. Many traders consider trading binary options as gambling

In binary options, you are speculating on the price movement of the underlying asset. In essence, you are betting on an uncertain outcome.

However, this is a highly debatable topic as certain traders argue that you use technical and fundamental analysis instead of blind betting in gambling.

2.Losses are substantial:

If you lose your price prediction, you get nothing in return as well as lose your initial investment.

If you have placed a big trade worth thousands of dollars, you can lose it all in an instant.

3.Not permitted in certain locations:

Binary options are a popular form of trading. However, it has been banned in certain locations such as Europe.

The European Securities and Markets Authority has placed a ban on selling binary options to retail traders.

4. Riskier than other forms of trading:

Unlike CFD or forex trading, you can control your losses in case your position moves steeply against the market.

You cannot place stipulations such as stop losses or take profits to ensure your profits your cut your losses.

In binary trading, when you lose, you lose everything.

In a 2017 ASIC review, it was found nearly 80% traders lost money with binary trading.

The probability of accurately guessing the outcome of a binary trade is lower than you think.

The mid-point of the buy price and the sell price can be used to forecast if the trade will be successful or not.

The success rate is often between 10-20%. It boils down to how well you perform your trading analysis.

Finally, there is the risk of counter party.

If your broker fails to deliver your payout, it will be troublesome for you to get your money back.

“RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK”

Conclusion

This article is intended to be a binary options guide.

We have covered what binary options are, the different types of binary options, the common terms related to binary options, the assets that can be traded as binary options.

We then discussed how to trade binary options, explained binary options with the help on an example, and finally the advantages and disadvantages of trading binary options.

We hope after reading this article, you now have a basic understanding of how binary options work and how to trade them.

Start with a small investment and invest in those markets that you are comfortable with.

Take trading losses as a lesson instead of a setback.